Hydrogen in urban mobility: supporting the green transition

With more than half of global projects applying hydrogen technology to mobility are concentrated in Europe, what does the market look like for hydrogen in the urban mobility sector?

On 8 July 2025, the EU adopted a delegated act introducing a comprehensive greenhouse gas emission methodology for low-carbon hydrogen and fuels, as set out in the Hydrogen and Gas Market Directive. This follows the EU’s European Hydrogen Strategy and the Sustainable and Smart Mobility Strategy, which collectively signal the centrality of hydrogen for tomorrow’s economy.

Hydrogen (H2) offers a low-carbon alternative to fossil fuels, producing only water vapour as a by-product of the process of generating electricity. Stored in fuel cells in a pressurised container, when the hydrogen fuel is combined with oxygen from the air, an electrochemical reaction produces electricity, heat and water, generating energy twice as efficiently as combustion.

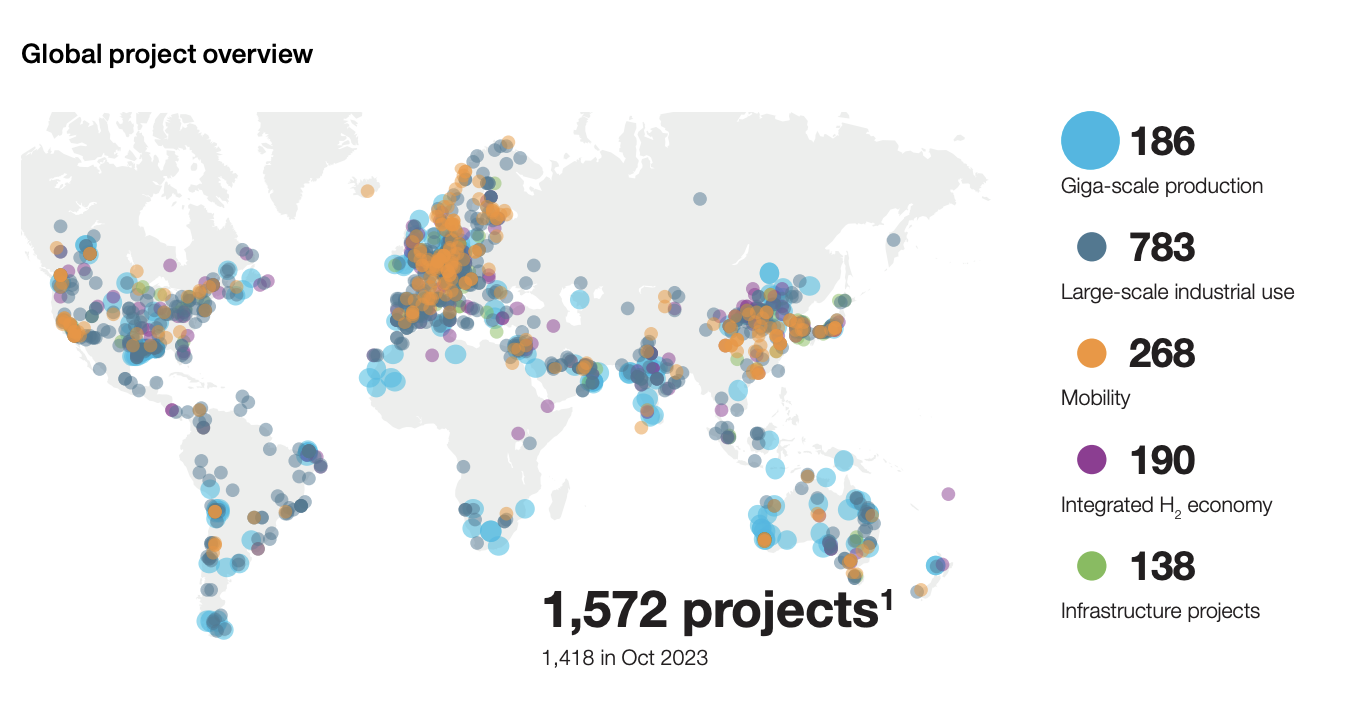

While hydrogen technology is still emerging in terms of widespread adoption, transport is one of the sectors with most potential for successful H2 integration. As of May 2024, 1,572 clean hydrogen projects had been announced globally, with 268 of those dedicated to mobility. More than half of global projects applying hydrogen technology to mobility are concentrated in Europe. So, what does the market look like for hydrogen in the urban mobility sector?

Figure: Hydrogen Council report (2024)

Hydrogen powered vehicles: market trends

While electric vehicles (EVs) are rapidly gaining ground in passenger transport thanks to their efficiency and expanding charging infrastructure across Europe, the use of fuel cell technology for commercial vehicles, particularly heavy-duty vehicles (HDVs) including trucks and buses holds notable potential.

According to a report produced by EIT Urban Mobility in collaboration with Eurecat, hydrogen trucks are expected to represent a €13bn market in Europe by 2030. In the public transport sector, the hydrogen bus market is expected to grow steadily in the coming years, although market size forecasts for this segment are varied.

Hydrogen offers a promising alternative to decarbonising bus fleets where there are limitations to the capacity of electric networks. Public transport operators – like TMB in Barcelona who have already established their transition to zero-emission vehicles with a sizeable, reliable fleet of battery electric vehicles (BEVs) – are now experimenting with the use of hydrogen vehicles to support the PTO’s decarbonisation targets.

In this way, hydrogen vehicles play a complementary role, providing an additional pathway to decarbonisation where there are limitations to grid capacity or recharging infrastructure. Hydrogen can provide stability and reliability to the network by reducing the strain of high demand for electricity from the grid.

Retrofitting for future-proof vehicles

Rather than competing directly with EVs, hydrogen technology can support the transition to zero-emission through the retrofitting of existing vehicles running on diesel. The EIT-supported HERO project aims to do just this, transforming a minibus vehicle from the TMB bus fleet into a fuel cell vehicle, with the aim of extending the operational ability of the vehicle. The project will produce a retrofit kit to allow for replicability.

Here, hydrogen stands apart from BEVs as a zero-emission alternative to diesel: as minibuses are too small for the installation of large batteries, fuel cell technology can provide a more space-efficient alternative, with similar performance to diesel buses in terms of autonomy, weight and manoeuvrability, but with no emissions and a longer range than BEVs.

Another solution, HYIPTRAIN, offers a retrofit kit to convert diesel passenger trains into hydrogen powered internal combustion passenger trains, reducing the cost of introducing hydrogen into railway networks by 20x compared to purchasing new hydrogen passenger trains.

These solutions not only decarbonise vehicles by removing direct emissions, but also address the energy cost of producing brand-new vehicles to support decarbonisation efforts, providing a cost-effective and environmentally friendly pathway to cleaner transport.

Re-thinking hydrogen refuelling infrastructure

Along with the growing interest in hydrogen vehicles, particularly among HDVs covering long distances, comes a rising demand for hydrogen refuelling networks. The market for hydrogen refuelling stations (HRS) is expected to grow to between €151M and €495M by 2030, depending on the speed of HRS deployment across Europe. Since the introduction of AFIR (Alternative Fuels Infrastructure Regulation), which requires refuelling stations to be installed no more than 200 km apart along the Trans-European Transport Network (TEN-T), with at least one station available in every urban node, the number of HRS across Europe is expected to rise to more than 650.

However, until further HRS stations are commissioned, hydrogen distribution operators are under strain following this increased demand, with risks of:

Hydrogen losses: discrepancies between hydrogen distributed and delivered pointed to possible losses - both in fuel and financial terms.

High default rates: increased strain on compressors, dispensers, and storage systems led to equipment failure and system unreliability.

Limited operational visibility: without real-time monitoring, issue detection was reactive and inefficient, delaying resolution and exacerbating downtime.

Designed to respond to these risks, Hyggle’s SCADA Hypervision, a cloud-based Sofware-as-a-Service solution conducts performance analysis, alerting hydrogen refuelling stations in real-time.

By improving refuelling reliability and efficiency as well as mitigating hydrogen loss, Hyggle’s SCADA Hypervision transforms complex hydrogen refuelling infrastructure into an intelligent, automated system that ensures maximum uptime, efficiency, and cost control.

In addition to optimising existing infrastructure, new initiatives are exploring innovative models for HRS. ACTIVA H2, a project co-financed by EIT Urban Mobility and led by Renewable Green Hydrogen (HVR Energy), Wolftank Iberia and the BMW Group offers an innovative solution.

Rather than relying on costly, complex HRS infrastructure that can often deter operators and fleet owners from investing in hydrogen technology, ACTIVA H2 provides a modular, transportable HRS system which can be easily adjusted according to client demands. The innovative “HRS-as-a-Service” model allows businesses to rent the station and avoid high upfront costs, reducing the initial investment cost by x10 compared with typical HRS infrastructure, encouraging fleet operators to make the switch.

Considering the bigger picture

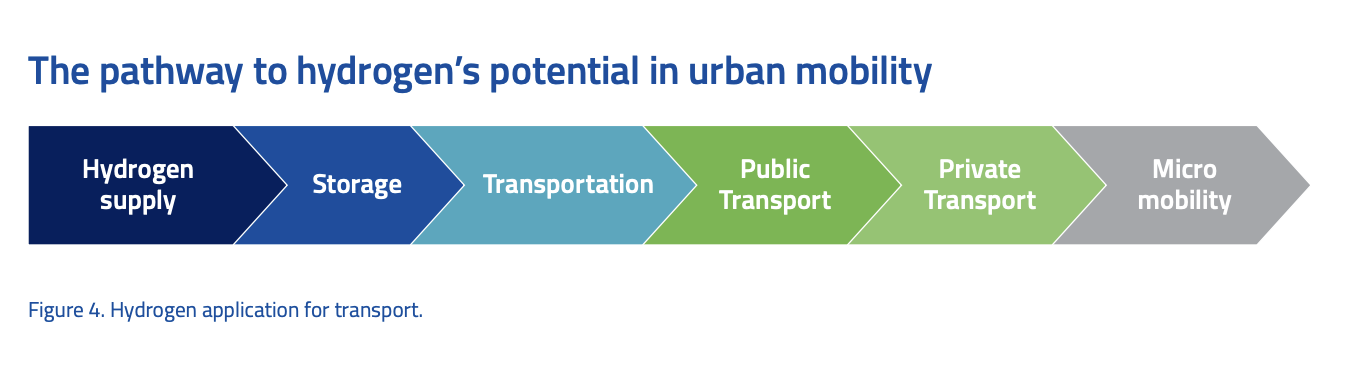

Refuelling is not the only consideration to be made in the introduction of hydrogen to urban mobility. Storage, distribution, and sourcing are all relevant considerations. The market for hydrogen storage and distribution systems in Europe is expected to reach an estimated €10bn by 2030, as energy storage will become even more important in years to come.

Figure: The Role of Hydrogen in Urban Mobility (2024)

A major sticking point when it comes to the sustainability of hydrogen is in the sourcing – though available from renewable sources, currently 95% of hydrogen production is derived from fossil fuels. This is one of the key issues along the value chain that must be addressed in order to make hydrogen a reliable and sustainable power source suitable for widespread adoption. The production of renewable hydrogen is one of the EU’s priorities, signalling an encouraging shift in the right direction.

The way forward

The bottom line when it comes to integration of hydrogen into mobility infrastructure? Cross-sector collaboration will be vital going forward. Collaborative research and development are fundamental to facilitate the development of cost-effective and sustainable hydrogen production technologies. Scalability, efficiency, and environmental sustainability should form the driving force of such initiatives.

Ultimately, facilitating the uptake of hydrogen in urban mobility is not a linear process, and will require input and innovation at all levels of the value chain. If your company or startup is developing a solution that addresses key challenges at any level of the hydrogen value chain, get in touch with the Mobility Innovation Marketplace team to explore opportunities to showcase your solution, and join the movement towards clean urban mobility.