The evolution of Shared Mobility trends in Europe

The start of 2023 brought challenges and shifts to Europe's shared mobility market. Several cities and operators ceased services and imposed vehicle limits, including Paris banning shared scooters and companies like Bird and GO Sharing exiting unprofitable markets. Despite these transitions, the shared mobility market is adapting to rising demand.

In Q2, Europe's shared mobility market reflected these changes. Fleet size grew by 7%, but ridership remained stable (-1%). Free-floating bikes increased, although lower usage affected trips per vehicle per day. Moped trips declined due to operator exits, while scooters struggled due to regulatory changes and higher costs. Cars stood out, experiencing substantial growth with ridership up by 14%, surpassing fleet growth (6%).

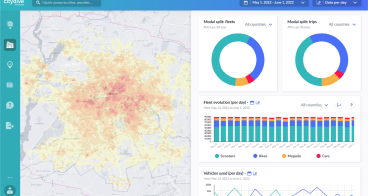

The recently released European Shared Mobility Index Q2 by Fluctuo provides a comprehensive overview of the entire European market this time comparing Q1 and Q2 2023. The analysis is rooted in a diverse selection of European cities, specifically chosen to represent varying sizes, geographical locations, and market characteristics. A subset of 33 cities was meticulously studied to discern overall ridership trends, offering invaluable insights for the report.

Bikes: Dominating urban commuting

In Q1 2023, dockless bikes emerged as the dominant mode of urban commuting, outpacing scooters, mopeds, and cars. They experienced remarkable growth, expanding by 33%. However, weather-related challenges impacted ridership. By Q2 2023, bikes continued their dominance, with a 66% growth in dockless bike usage in cities like Paris and Berlin. Operators adapted, focusing on diversifying fleets and ensuring a reliable bike-sharing experience despite weather fluctuations.

Scooters: Adaptation to new regulations

Public tenders became the standard for regulating shared scooters in Europe. Cities like Bordeaux and Oslo set examples by reducing operators and implementing maximum fleet sizes, leading to increased profitability and ridership. In Q1, the industry was still adapting to these tenders. By Q2, despite challenges, scooters continued to be a significant mode, constituting 42% of shared mobility trips. However, cities like Paris and Brussels planned substantial reductions in scooter fleets by 2024, indicating a changing landscape. On the brighter side, one (continuing) success story is that of Bordeaux, where ridership has more than quadrupled since last year after a tender limited operators to just two, but with a much larger allocation of vehicles for each operator.

Mopeds: Balancing limited presence and challenges

Mopeds, with limited prevalence, faced challenges in Q1 due to exits in key markets, impacting global ridership. Operators like TIER and Felyx encountered profitability challenges. By Q2, steady growth was observed in countries like France, Spain, Italy, and the Netherlands. However, questions arose about the market potential, with uncertainties about reaching a saturation point, similar to scooters. On another note, ridership in Turin doubled, and remained consistent with last year’s in Bordeaux. Mopeds continue to be popular in Seville.

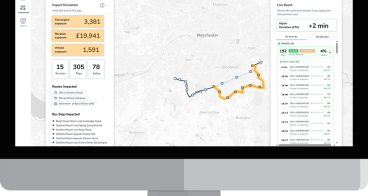

Cars: Focus on sustainability

This time shared cars are the mode showing the biggest growth compared to Q2 of last year. The car-sharing industry evolved from OEM dominance to a diverse landscape, with growth seen in overlooked markets like Poland and Belgium. Shared cars demonstrated significant growth, especially in German cities like Berlin and Hamburg, where ridership increased by 34% and 50%, respectively. Free-floating car sharing services surged, constituting 85% of all car sharing services. Unlike station-based services, free-floating trips offered a more flexible and frequent use case, contributing to their popularity.

Between Q1 and Q2 2023, shared mobility in Europe showcased resilience and adaptability. Bikes continued to dominate urban commuting, while scooters faced challenges amid regulatory shifts. Mopeds observed varying growth rates, raising questions about market saturation. Car sharing diversified and focused on sustainability, yet grappled with electrification challenges.

Overcoming obstacles in infrastructure, regulation, and profitability remained crucial for shared mobility's sustainable growth, highlighting the industry's ongoing need to innovate and navigate a complex landscape.

Explore the latest Shared Mobility trends in European cities with Fluctuo's city data! Ensure you don't miss out - download the complete report from the files section below.

Published on 19 June 2023.