What are the current Shared Mobility trends? | European Shared Mobility Index

In the last year, the dynamic landscape of shared mobility, as revealed by the European Shared Mobility Index carried out by Fluctuo, has seen an 18% increase in income generated by shared mobility, a 10% increase in trips on shared vehicles, and a 7% increase in shared vehicles fleet.

A comprehensive analysis of the data underscores the evident transformations within the European mobility ecosystem. These changes were propelled by the widespread adoption of tenders, an increase in dockless bike usage and shared cars ridership, and the emergence of new services despite challenges in bans and regulations.

Shared mobility performance highlights

Data shows a 7% increase in shared mobility from last year, with approximately 930,000 vehicles (including bikes, mopeds, cars, and scooters) operating, and carrying out over 600 million trips, which is a 10% increase from 2022. Scooters take up 56% of the modal breakdown, being the vehicle type with the largest fleet and highest percentage of trips, followed by station-based bikes with 20% and dockless bikes with 14%. However, despite scooters having the largest modal breakdown, this mode of transport has experienced negative growth in service provision, shedding light on challenges faced by this mode. Instead, there is an increase in cities using dockless bike services and shared cars.

Overall, the end user income generated in shared mobility has risen by 18% from 2022, resulting in a revenue of €2.3 billion.

This data has emerged from the analysis of 115 European cities, fifteen more than last year’s report. Most of these cities are subscribed to the EU ‘100 Climate Neutral and Smart Cities by 2030’. The country with the most shared ridership services is Germany, followed by Belgium, Italy, and France.

Dockless bike boom across European cities

The dockless bike-sharing landscape is flourishing, particularly in cities like London, Paris, Copenhagen, Milan, and Rome. Its ridership and fleet size is up by more than 50% in 2023, taking over from the scooters that led the market from 2019-2022. Dockless bike sharing is considered the most cost-effective and convenient choice, allowing users to park them in any public space without the need for administrative investments in docks. This contributes to users' preference for this service.

Another reason why dockless bikes are booming is due to the scooter bans in certain cities, such as Paris. Operators have had to change modal type in order to survive, which has generally had a positive effect given the preference for bikes over scooters.

However, while dockless bikes are on the rise, station-based bikes still take up over double the ridership, with cities like Madrid having a 13% increase thanks to the provision of new, electric bikes (7,500 new units) and cheaper pricing due to subsidies. This is not to say that cities with a higher dockless bike presence, such as London with Forest and Lime, are detrimentally affecting the ridership of the station-based Santander Cycles.

Notwithstanding the overall positive trends in securing short-term futures for bike operators such as TIER and Dott, there were also setbacks in terms of problems with bikes blocking the pavement or the shutdown of Stockholm eBikes partly due to safety issues related to fragile bike frames. However, Ridemovi swiftly stepped in to fill the gap by offering a dockless electric bike service. These instances highlight the importance of addressing safety concerns to ensure the sustainability of shared mobility services.

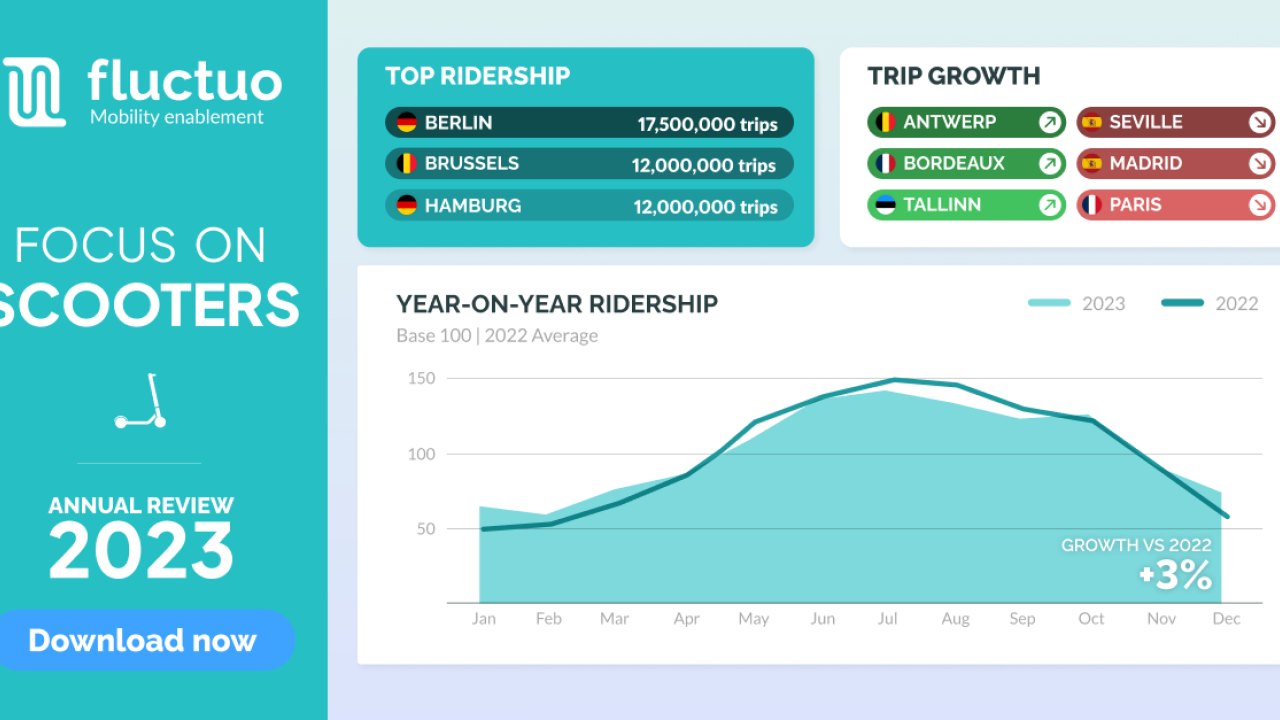

Scooter resilience amid challenges

Despite the tightening of regulations across Europe, scooters have managed to resist challenges and result in a 1% fleet size increase and 3% increase in ridership, but through having to reduce costs, increase prices, make layoffs, and exiting unprofitable markets.

It is interesting to highlight that whilst large cities are seeing a decrease in scooter fleets, such as Berlin and Brussels, due to fleet caps, this fleet is being moved to smaller and mid-size cities and therefore the overall fleet size is remaining stable. There is also an increasing geographic gap, with scooter fleets decreasing in Northern and Southern Europe but increasing in Eastern Europe by no less than 33%. Nonetheless, Berlin and Brussels remain the cities with the largest scooter ridership, followed by Hamburg, Munich, and Paris (before the ban).

Tenders shaping the landscape

One of the prominent trends shaping the shared mobility landscape is the influence of tenders. Tenders have played a pivotal role in reshaping the availability of shared vehicles, with cities like Rome and Madrid witnessing major shifts. In 2023, nine companies operated a total of 20,000 scooters in Brussels, whilst now only 8,000 scooters operate exclusively with Bolt and Dott. Generally, companies such as Bird, Bolt, Dott, Lime, and Voi have secured short-term futures through mergers with other operators. However, companies such as Reby, Superpedestrian or Cityscoot were not able to secure funding in time.

As we look forward, the report suggests that tenders will continue to play a crucial role in defining the European mobility landscape.

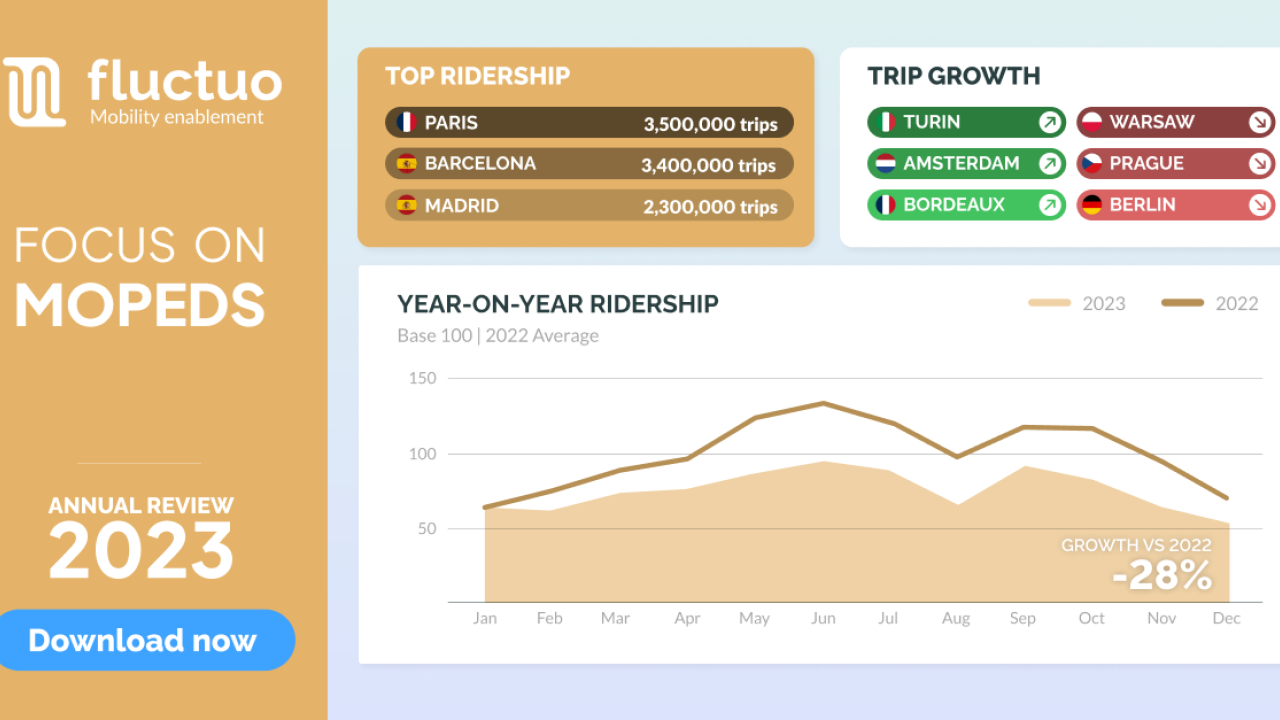

Moped market challenges and opportunities

The moped market faces challenges with exits in cities like Barcelona, Milan, and Madrid, leading to a decline in ridership of 28% and of 27% in fleet size overall. Unlike scooters, moped fleets are reduced due to a lack of investments and low profitability. Paris, which is considered a lucrative market, poses financial challenges for moped operators, emphasising the need for cities to create favourable conditions for their success.

Moped companies have attempted to address these challenges by expanding to new cities in order to maintain the fleet size stable, but this action has proven to be costly, resulting in having to close down subsidiaries such as Acciona exiting Rome and Milan to focus on Spanish cities, or ramping down, or even selling to competitors, like Go Sharing was sold to BinBin or like Cityscoot was acquired by Cooltra.

An additional challenge for mopeds has been the increase in safety regulations, such as the Netherlands making it mandatory to wear a helmet. Otherwise, Eastern Europe is also experiencing a decrease in moped fleet size due to vandalism and theft. These challenges have allowed southern European cities to remain at the top of moped ridership, including Paris, Barcelona, Madrid, and Milan.

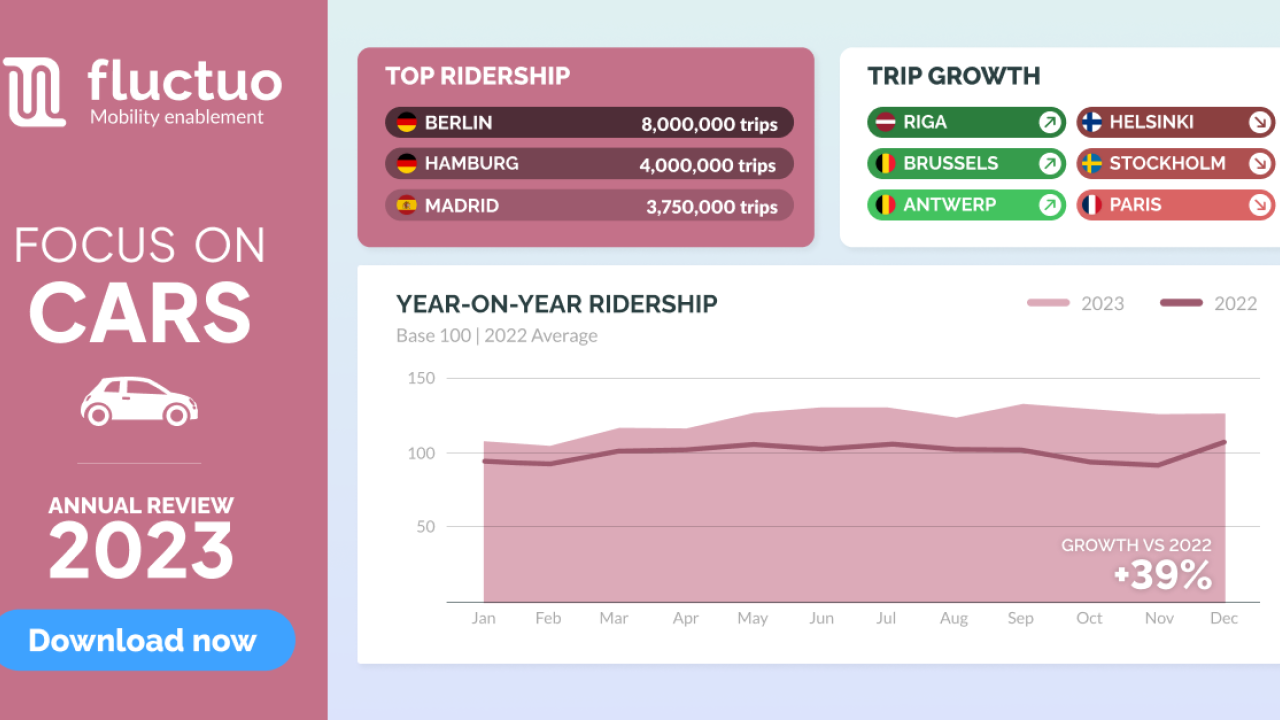

Shared car ridership continues to soar

Shared car ridership remained consistently high, showcasing impressive usage in 2023 with an increase in fleet size of 25% and in ridership of 39%. The introduction of services like Bolt Drive in Riga and Miles Mobility in Antwerp contributed to being at the top of the list for ridership growth, while German cities continue to dominate total shared car trips per city.

However, companies are struggling to find profitability in moped ridership, with several selling or rebranding or even ceasing operations, such as Zity in Paris. This suggests that in order for shared car ridership to succeed, it requires incentives from public authorities, such as lowering parking fees or creating reserved parking, as Madrid or Budapest have done.

Conclusion

As the European shared mobility landscape evolves, operators face both opportunities and challenges. After raising hundreds of millions between 2018 and 2021, operators are finding it challenging to raise additional funding. No major funds have been raised since Bolt’s €630m in 2022. Operators have had to be frugal and make every cent count: reducing costs, increasing prices, exiting unprofitable markets and making lay-offs.

However, they are also starting to develop new offers - shared bikes featuring heavily. The bike-sharing boom and resilient scooter performance underscore the adaptability of the market. Shared car usage remains robust, with new entrants contributing to the growth.

In navigating this dynamic landscape, operators must adapt strategies to address safety concerns, capitalise on emerging opportunities, and collaborate to overcome financial challenges, ensuring the continued success of shared mobility across European cities.

The European Shared Mobility Index by one of EIT Urban Mobility trusted startups, Fluctuo, provides key stakeholders with the most exhaustive, accurate data on the market to accelerate the growth of shared mobility.

Originally published on 16 June, 2023.

Reviewed on 31 May, 2024.

Our forecasts for ridership and revenue in 2024 are optimistic. The disappearance of certain operators and the increase in calls for tender will create the opportunity for European champions to emerge. Admittedly, there will be less competition. But the financial solidity and operational control of the remaining players will enable the continued development of shared mobility services, for the greater benefit of European cities and their inhabitants.