How can we make electric mobility more sustainable? Circular business cases

The electric mobility revolution needs its own ‘fuel’ – millions of batteries made up of tonnes of scarce raw materials. Fortunately, unlike oil, this fuel can be kept in the loop. In this article, Bax & Company Innovation Consultant Piotr Grudzień explores several examples of how innovative battery companies create value from circular practices, based on first-hand insights from the partners of the BatteReverse project.

In 2030 alone, Europe will face the task of producing over nine million electric vehicles, which will require batteries with approximately one million tonnes of critical raw materials such as cobalt, nickel, manganese, and lithium. These rare metals, predominantly sourced and processed outside of Europe, pose a major supply chain challenge for the automotive industry, as is the efficient and safe treatment of generated battery waste. It’s estimated that more than 300,000 tonnes of batteries will have to be collected and recycled in 2030, but how can this be done efficiently and safely?

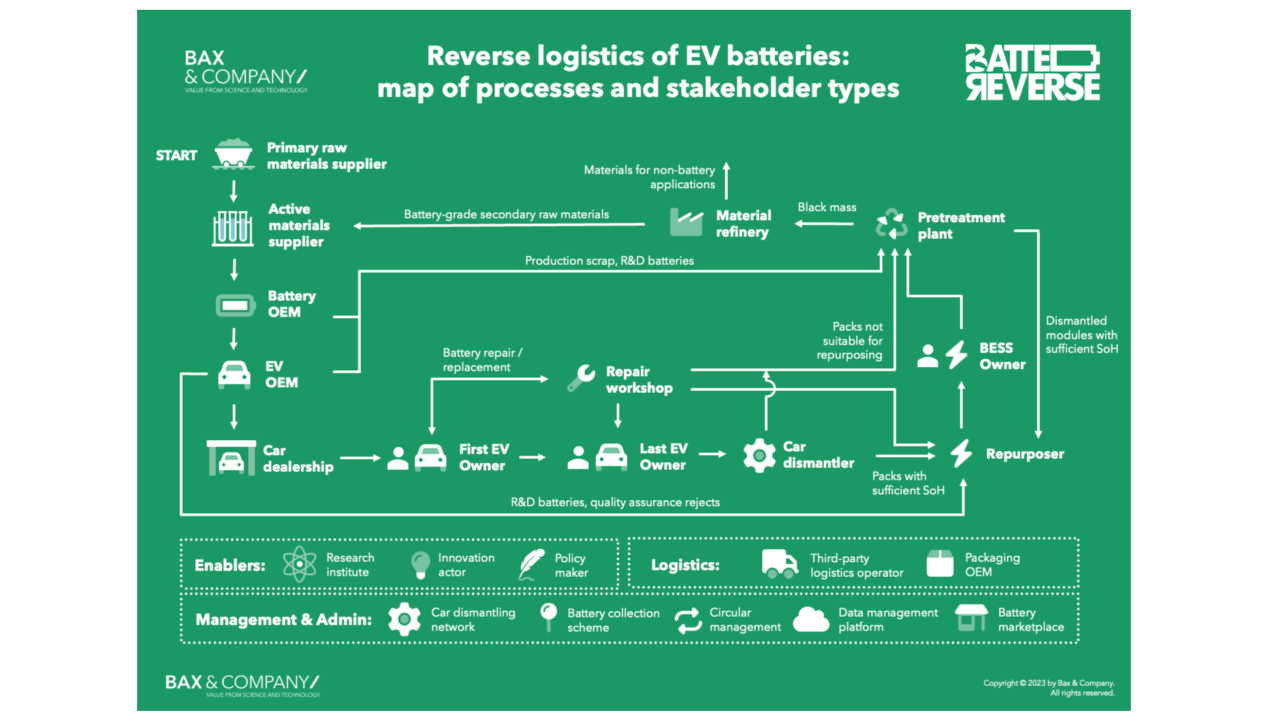

The BatteReverse project, an EU-funded initiative launched in 2023, is dedicated to improving the reverse logistics of EV batteries through developing new technologies, optimising existing processes, and setting up innovative collaborations. As part of the project, Bax & Company has mapped more than 150 key companies in Europe and analysed over 20 stakeholder types, as depicted in the image below.

Given that reverse logistics have not yet been standardised, the processes and roles within companies continue to evolve. This dynamic environment presents opportunities for established players like OEMs and recyclers, as well as new market entrants, including startups in data management or second-life battery products. The following four business cases present examples of how these key stakeholders are collaborating with other companies to improve battery circularity, whilst reducing costs and generating profits.

No battery should be wasted – sourcing batteries for second-life at Škoda Auto

The introductory visual illustrates that battery waste is not solely generated after usage. Currently, most batteries requiring treatment are those discarded during the production phase. This is predominantly because most EV batteries are still on the roads, and it typically takes between 10 to 15 years for them to reach their end of life. This is also the case for Škoda Auto, a car manufacturer relatively new to mass-producing electric vehicles. In line with other EV OEMs, Škoda finds that a certain percentage of their batteries are deemed unsuitable during quality assurance and R&D processes. While these batteries may not meet the standards for new vehicles, they often retain a considerable amount of useful life (over 70%), making them viable for alternative uses, such as stationary storage systems.

That’s why the OEM enters into agreements with various integration partners to explore second-life opportunities for batteries. Pilot projects have shown that, in stationary systems, battery cell capacity diminishes by only about 2% per year, potentially extending battery life up to 15 years. This approach significantly reduces the carbon footprint associated with the entire lifecycle of batteries.

From Škoda Auto’s perspective, each battery that is repurposed for a second life signifies not only a reduction or postponement of recycling costs but also a potential revenue stream. Once these batteries have fulfilled their second life, they can be recycled in accordance with circular economy principles, allowing their raw materials to be reclaimed for new cell production.

Maximising the lifetime of batteries: fleet monitoring by Bib Batteries

Choosing the most effective strategy for retired e-mobility batteries is not always easy. Bib Batteries, a French company, has developed a data-driven solution to this problem. Their algorithm assesses the residual market value of batteries, enabling them to offer battery fleet operators with the best solution: repair, second-life usage, or recycling. This system includes a digital registry for technicians to scan and manage fleet batteries via QR codes, facilitating incident reporting and providing specific instructions for repair, second-life applications, or recycling.

Bib Batteries’ value proposition centres on minimising the costs of vehicle operators by assisting in the monitoring and optimisation of their battery fleets, as well as in maintaining efficient maintenance and circular management practices. The company usually offers a more cost-effective alternative to pure recycling, allowing operators and manufacturers to preserve cash flow while responsibly disposing of batteries. Currently, while most of Bib Batteries' clientele are micromobility operators, the French start-up is expanding its services to include EV OEMs as well.

Giving a second life to spent EV battery modules: repurposing at betteries AMPS

Repurposing spent EV batteries has emerged as a distinct business model, with many innovative start-ups popping up across Europe. While most focus on post-production batteries, like those from Škoda Auto, only a select few tackle the more complex challenge of post-consumer EV batteries. One such example is the Berlin-based start-up betteries AMPS. This company specialises in creating certified, circular, mobile, modular, and multi-purpose energy storage systems that serve as eco-friendly alternatives to traditional, pollutant fuel-powered generators.

Batteries AMPS primarily sources used EV battery packs from the Renault Group. These packs are dismantled into battery modules and based on their remaining capacity, modules are sorted and upcycled into modular building blocks, called betterPacks. Once the modules are assembled and equipped with a Battery Management System (BMS), these energy systems are connected to a digital business platform, facilitating asset tracking and energy management.

The primary application for betteries AMPS's second-life products is in remote areas requiring clean and reliable off-grid power. Clients value the environmental benefits of these second-life solutions, their ease of use, and the capability to monitor and manage the modules. However, repurposing companies like betteries AMPS often encounter challenges in securing a consistent supply of used EV batteries, making partnerships with OEMs, fleet operators, workshops, and dismantlers crucial for success.

Transforming end-of-life battery packs into commodity-grade materials: recycling at TES

When all other circular options for EVs have been explored, recycling becomes the final step to recover secondary raw materials for new battery production. This process, undertaken by recyclers such as BatteReverse partner TES, is divided into two steps: pre-treatment and hydrometallurgical recycling. In the pre-treatment phase of EV battery recycling, the battery pack is discharged, and its modules are extracted. The remaining components are sorted and recycled, with reusable modules assessed based on their State-of-Health (SoH). Modules deemed unreusable are further discharged and segregated, then processed into fine substances, and then separated into steel, plastics, and active materials in the form of a black mass. The black mass is transported and undergoes hydrometallurgical treatment, separating it into valuable materials like lithium, nickel, cobalt, and manganese.

TES operates a service-led business model with additional value recovery opportunities. Customers pay for recycling services, providing a predictable income stream.

To increase the profitability of these business models, the recycling processes must overcome several bottlenecks. The dismantling of the battery pack is very time-consuming and labour-intensive. That’s why, the BatteReverse project is exploring human-robot collaboration to automate the process. The limited scale of recycling operations in Europe poses another challenge, with insufficient facilities to handle the growing volume of battery waste. To minimise logistics and reduce the carbon footprint, deploying more hydrometallurgical plants in Europe is crucial.

The value of collaboration: the biggest network for battery circularity experts

All the business models presented above have one thing in common: they harness the power of collaboration to optimise the use of EV batteries. Recognising the importance of these valuable connections, the BatteReverse Community – the largest network of experts in battery circularity has been created. On the platform, companies, researchers, and policymakers can discuss the most pressing issues in reverse logistics, exchange best practices, and forge new collaborations. The BatteReverse team regularly publishes the most relevant news and insights on related policy, market, and technology developments. Community members have the chance to engage with each other using dedicated topic spaces and connect during the Short Circuit webinar series. If you’ve made it to the end of the article, this means you should join us and contribute to these vital conversations.

By Piotr Grudzień, Innovation Consultant at Bax & Company

Piotr Grudzień is an innovation consultant specialising in battery circularity. Along with his team at Bax & Company, he helps the battery value chain and the automotive industry in implementing innovative solutions and business models to maximise value from electric mobility batteries, while minimising their environmental footprint.

Contact: [email protected]